How to open IRA account Bank of America? This question, echoing the quiet hum of financial planning and the whisper of future security, unlocks a pathway to securing your tomorrows. Embark on a journey of financial empowerment as we illuminate the steps, choices, and considerations involved in establishing your Bank of America IRA. This isn’t merely about paperwork; it’s about cultivating a future rich with possibility, a testament to your commitment to long-term well-being.

Understanding the nuances of Traditional, Roth, and Rollover IRAs, the diverse investment options, and the associated fees empowers you to make informed decisions, aligning your financial strategy with your personal aspirations.

From navigating the eligibility requirements and understanding the various account types to mastering the online and in-person application processes, we’ll guide you through each stage with clarity and precision. We’ll demystify the investment options available, empowering you to choose wisely based on your risk tolerance and financial goals. Furthermore, we’ll equip you with the knowledge to navigate fees and utilize Bank of America’s resources to maximize your retirement savings potential.

This comprehensive guide is your compass, leading you towards a brighter financial future.

Eligibility Requirements for a Bank of America IRA Account

Opening a Bank of America IRA involves meeting specific eligibility criteria. Understanding these requirements ensures a smooth application process.

Minimum Age Requirements

To open an IRA with Bank of America, you must be at least 18 years old. While there’s no upper age limit, contribution limits may apply based on your age and income.

Opening an IRA at Bank of America is straightforward; simply visit their website or a branch. However, if you’re transferring funds from another institution, understanding the process is crucial. For instance, if you’re transferring from CIT Bank, researching the specifics of their CIT bank div of transfer process will help ensure a smooth transition into your new Bank of America IRA.

This prior preparation will simplify the overall IRA opening experience at Bank of America.

Required Documentation for Identity and Residency Verification

You’ll need to provide documentation to verify your identity and address. This typically includes a government-issued photo ID, such as a driver’s license or passport, and proof of address, like a utility bill or bank statement.

Acceptable Income Sources

Bank of America accepts various income sources to demonstrate your eligibility. This includes salary, wages, self-employment income, rental income, and investment income. You will need to provide documentation supporting your income source.

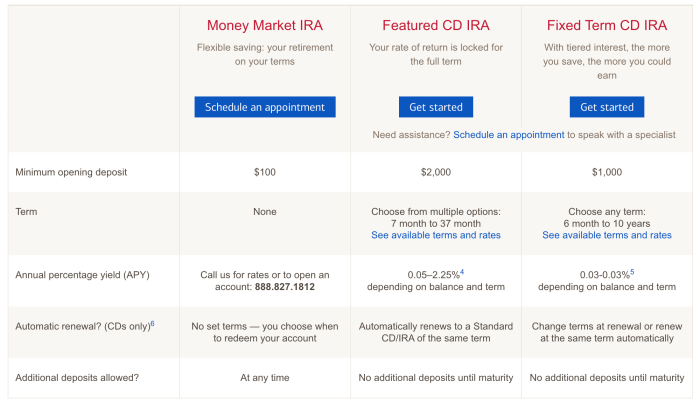

IRA Account Types and Eligibility

Bank of America offers Traditional, Roth, and Rollover IRAs. Eligibility for each type depends on factors like your income, age, and whether you’re rolling over funds from a previous retirement account. Traditional IRAs offer tax deductions on contributions, while Roth IRAs offer tax-free withdrawals in retirement. Rollover IRAs allow you to transfer funds from existing retirement plans. Specific income limits apply to Roth IRA contributions.

Opening a Bank of America IRA Account Online

Opening an IRA online with Bank of America is a straightforward process. The following steps provide a guide.

Step-by-Step Online Application Process

| Step | Screenshot Description | Description | Notes |

|---|---|---|---|

| 1. Visit Bank of America Website | The Bank of America homepage showing the “Retirement” or “IRA” section. | Navigate to the Bank of America website and locate the section dedicated to retirement accounts. | Look for prominent links or banners related to IRAs. |

| 2. Select “Open an IRA” | A screenshot of the page where you select the type of IRA (Traditional, Roth, Rollover). | Click on the option to open a new IRA. You’ll likely be prompted to choose the type of IRA you wish to open. | Carefully review the differences between each IRA type before making your selection. |

| 3. Provide Personal Information | A sample form showing fields for name, address, social security number, etc. (Note: No actual sensitive data should be shown). | Enter your personal information accurately and completely. This includes your name, address, date of birth, and Social Security number. | Double-check all information for accuracy to avoid delays. |

| 4. Choose Investment Options | A sample screen showing various investment options like mutual funds or ETFs. | Select your preferred investment options based on your risk tolerance and financial goals. | Consult a financial advisor if needed. |

| 5. Review and Submit | A screenshot of the review page summarizing your application details. | Thoroughly review all information before submitting your application. | Once submitted, you cannot easily make changes. |

Funding Your IRA Account

After account creation, you can fund your IRA through various methods, including bank transfers, checks, and potentially electronic transfers from other accounts. Linking an external bank account simplifies the funding process, allowing for recurring contributions.

Opening a Bank of America IRA Account In-Person

Opening an IRA at a Bank of America branch offers personalized assistance.

Necessary Documents for In-Person Account Opening

Bring your government-issued photo ID, proof of address, and Social Security number. You may also need documentation related to your income and any funds you plan to roll over from a previous retirement account.

Steps Involved in Opening the Account

A bank representative will guide you through the application process, answering your questions and helping you choose the right IRA type and investment options.

Selecting Investment Options with a Financial Advisor

Bank of America offers financial advisors who can provide personalized guidance on investment choices based on your risk tolerance and financial goals.

Funding the Account In-Person

You can fund your account in person with a check or cash deposit. You may also be able to initiate a transfer from another Bank of America account.

Investment Options Available Through Bank of America IRAs

Bank of America offers a range of investment options to suit diverse risk tolerances and financial goals.

Comparing Investment Options

Mutual funds provide diversification across multiple securities, while ETFs offer low-cost exposure to specific market segments. Individual stocks and bonds carry higher risk but offer potential for greater returns. The choice depends on your investment strategy and risk tolerance.

Investment Options Table

| Asset Class | Risk Level | Potential Returns | Fees |

|---|---|---|---|

| Mutual Funds | Low to Moderate | Moderate | Vary by fund |

| ETFs | Low to Moderate | Moderate | Generally Low |

| Individual Stocks | High | High (Potential for Loss) | Brokerage Commissions |

| Bonds | Low to Moderate | Low to Moderate | Vary by bond |

Fees Associated with Investment Options

Fees vary depending on the chosen investment option. Mutual funds and ETFs typically have expense ratios, while individual stock and bond trades incur brokerage commissions.

Understanding Fees and Charges Associated with Bank of America IRAs: How To Open Ira Account Bank Of America

Various fees can be associated with maintaining a Bank of America IRA.

IRA Fee Schedule

Source: ciowomenmagazine.com

| Fee Type | Description | Amount |

|---|---|---|

| Annual Fee | Fee charged annually for maintaining the account. | Varies; may be waived under certain conditions. |

| Transaction Fee | Fee charged per transaction (e.g., buying or selling investments). | Varies; may depend on investment type and account type. |

| Investment Management Fee | Fee charged for professional investment management services. | Varies; depends on the type of managed account. |

Minimizing or Avoiding Fees

Many fees can be avoided by choosing low-cost investment options, maintaining a minimum balance, or using online banking features.

Comparison with Other Banks

Fee structures vary across banks. Comparing fees from several institutions is recommended before deciding.

Customer Support and Resources for Bank of America IRA Account Holders

Bank of America provides various resources for IRA account holders.

Contact Information and Resources

Contact information can be found on the Bank of America website, including phone numbers and online chat support. Their website also offers numerous help articles and FAQs.

Accessing Account Statements and Transaction History

Account statements and transaction history are accessible online through your Bank of America account.

Resolving Account-Related Issues, How to open ira account bank of america

Source: ira-reviews.com

A flowchart outlining the steps to resolve account-related issues would be beneficial (Note: A textual description is provided instead of a visual flowchart). Generally, contacting customer support directly is the first step. Escalation to a supervisor or higher authority might be necessary for complex issues.

Illustrative Example of a Bank of America IRA Account Setup

Let’s consider Sarah, a 25-year-old who decides to open a Roth IRA with Bank of America.

Sarah’s Roth IRA Setup

Sarah, after researching, decides on a Roth IRA due to its tax advantages for long-term growth. She chooses a mix of low-cost index funds and ETFs, aiming for a moderate level of risk. She contributes the maximum allowable amount annually.

Account Balance Projection

(Note: This is a hypothetical example and does not constitute financial advice. Actual returns will vary.) Assuming an average annual return of 7%, Sarah’s account could grow substantially over 10 years. Higher contribution amounts would naturally lead to a larger balance.

Tax Implications

Source: citizensfirstbank.net

With a Roth IRA, Sarah pays taxes on her contributions now, but withdrawals in retirement are tax-free. This contrasts with a Traditional IRA where contributions are tax-deductible now, but withdrawals are taxed in retirement. The best choice depends on individual circumstances and tax brackets.

Impact of Different Contribution Amounts

A higher annual contribution will lead to significantly higher account balances over time, due to the power of compounding. However, contribution limits exist.

Outcome Summary

Opening a Bank of America IRA is more than just a transaction; it’s a profound act of self-investment, a commitment to your future self. By understanding the process, the options, and the implications, you’re not merely opening an account; you’re cultivating a secure and prosperous future. Remember, this journey is about more than just numbers; it’s about securing peace of mind and creating a legacy of financial well-being.

Embrace the power of informed decision-making, and watch your financial potential blossom.