Does TD Bank use early warning services? This question is crucial for understanding the bank’s comprehensive approach to fraud prevention. This review examines TD Bank’s security measures, including its internal systems, partnerships with third-party vendors specializing in fraud detection, and its communication strategies with customers regarding fraud awareness. We will explore the bank’s proactive measures and its compliance with industry regulations.

The effectiveness of these combined strategies in mitigating financial risks for both the bank and its customers will be a key focus.

TD Bank employs a multi-layered approach to fraud prevention. This involves sophisticated internal systems for monitoring transactions, analyzing customer data to identify suspicious activity, and collaborating with external vendors offering specialized early warning services. The bank also provides robust customer reporting mechanisms and actively educates customers on how to identify and avoid fraudulent activities. Understanding these strategies is essential for assessing the overall security of TD Bank accounts.

TD Bank’s Fraud Prevention Strategies: A Deep Dive (with a Side of Humor): Does Td Bank Use Early Warning Services

Let’s face it, nobody likes fraud. It’s like that uninvited guest who shows up at your party and starts eating all the appetizers. TD Bank, thankfully, isn’t a fan either. They’ve implemented a multi-layered approach to keep your hard-earned money safe from those digital bandits. This article will explore their strategies, from internal systems to external partnerships, with a healthy dose of (hopefully) amusing insights.

TD Bank’s Internal Fraud Detection Systems

TD Bank utilizes a sophisticated network of internal systems designed to sniff out suspicious activity before it even gets a chance to reach your account. Think of it as a high-tech, financial immune system. These systems constantly monitor transactions, analyzing patterns and flagging anything that looks out of the ordinary – like a sudden surge in international transfers or a series of purchases from a suspiciously named online retailer (“BuyAllTheThings.com,” anyone?).

These systems are constantly updated and refined, learning from past events to improve their accuracy.

Account Monitoring and Fraudulent Activity Prevention

Source: xenonstack.com

Proactive account monitoring is crucial. TD Bank’s systems track your spending habits, identifying unusual transactions based on your typical behavior. If you suddenly start buying yachts after mostly purchasing groceries, expect a friendly call from TD Bank – not to congratulate you on your new purchase, but to confirm it’s actually you. This proactive approach minimizes the risk of fraudulent activity going unnoticed.

Utilizing Customer Data for Fraud Detection

TD Bank, like many financial institutions, uses customer data (with your consent, of course!) to enhance fraud detection. This isn’t about Big Brother watching your every move; it’s about using information like your location and transaction history to identify inconsistencies that could signal fraudulent activity. For example, if a transaction is registered in Tokyo while you’re clearly in Toronto, that’s a red flag that warrants further investigation.

Comparison of TD Bank’s Security Features with Other Major Banks

While we can’t reveal all the secret sauce, here’s a general comparison (think of it as a taste test, not a full recipe). Remember, specific features can change, so always check the individual bank’s website for the most up-to-date information.

| Feature | TD Bank | Bank A | Bank B |

|---|---|---|---|

| Real-time transaction monitoring | Yes | Yes | Yes |

| Biometric authentication | Yes | Yes | Yes |

| Fraud alerts | Yes | Yes | Yes |

| Advanced analytics | Yes | Yes | Yes |

Third-Party Services Used by TD Bank for Fraud Prevention

TD Bank doesn’t fight fraud alone. They partner with several reputable third-party vendors specializing in fraud detection and prevention. These vendors provide specialized tools and services that enhance TD Bank’s internal capabilities, creating a robust defense system.

- Transaction Monitoring Services: These services analyze massive amounts of transaction data in real-time, identifying patterns and anomalies that may indicate fraudulent activity.

- Identity Verification Services: These services verify customer identities using various methods, reducing the risk of identity theft and account takeovers.

- Advanced Analytics Platforms: These platforms utilize machine learning and artificial intelligence to detect sophisticated fraud schemes that might evade traditional methods.

Benefits and Drawbacks of Relying on External Services

Using third-party services offers access to cutting-edge technology and expertise. However, it also introduces dependencies and potential security risks. It’s a balancing act, like choosing between a delicious but slightly spicy dish – the rewards are great, but you need to be aware of potential side effects.

Customer Reporting Mechanisms at TD Bank, Does td bank use early warning services

If you suspect fraudulent activity on your account, reporting it promptly is crucial. TD Bank provides multiple channels for reporting, including online portals, phone calls, and in-person visits to branches. Their investigation process is designed to be thorough and efficient, aiming to resolve issues as quickly as possible.

Customer Reporting Process Flowchart

Source: hdnux.com

Imagine a flowchart here showing the steps involved in reporting suspected fraud and the subsequent investigation. It would start with the customer reporting the issue, then move to the bank’s initial assessment, investigation, and finally resolution and communication with the customer. Each step would be clearly labeled and visually connected to the next.

Communication Strategies for Fraud Prevention

TD Bank uses various communication channels to keep customers informed about fraud prevention best practices. This includes email alerts, website articles, social media campaigns, and educational materials. The goal is to empower customers to protect themselves from becoming victims of fraud.

Early Warning Systems in the Banking Industry

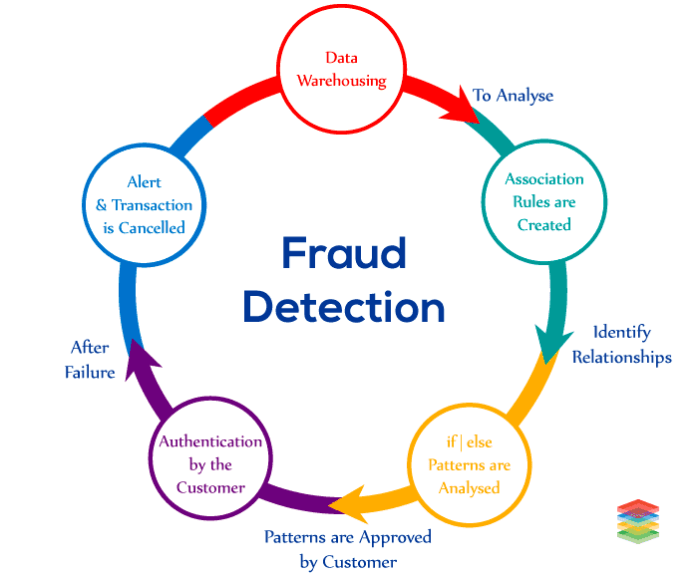

Early warning systems (EWS) are the unsung heroes of fraud prevention. They act like a financial canary in a coal mine, detecting subtle shifts and patterns that might signal an impending fraud attempt. These systems leverage advanced analytics and real-time monitoring to identify anomalies and trigger alerts before significant damage occurs.

Key Components of a Robust Early Warning System

- Real-time transaction monitoring

- Anomaly detection algorithms

- Data aggregation and analysis

- Alerting and escalation procedures

- Regular system updates and refinements

Regulatory Compliance and Fraud Prevention

TD Bank operates within a strict regulatory framework designed to protect consumers and maintain financial stability. Compliance with these regulations is paramount, shaping their fraud prevention strategies and the implementation of early warning systems.

So, does TD Bank use early warning services? It’s a complex question, depending on the specific service and threat. Understanding large transaction limits is key, and that brings us to the cit bank wire transfer limit , which illustrates how banks manage risk. Back to TD Bank, their early warning systems likely involve similar considerations of potential fraud and large-scale financial movements.

Key Regulations and Their Impact on TD Bank’s Fraud Prevention

| Regulation | Impact on TD Bank’s Fraud Prevention |

|---|---|

| [Regulation 1 – e.g., BSA/AML] | [Description of impact – e.g., necessitates robust KYC/AML procedures] |

| [Regulation 2 – e.g., GDPR] | [Description of impact – e.g., influences data handling and privacy measures] |

| [Regulation 3 – e.g., CCPA] | [Description of impact – e.g., dictates how customer data is collected and used] |

Customer Education and Fraud Awareness

Empowering customers with knowledge is a crucial part of fraud prevention. TD Bank employs various methods to educate customers about common fraud schemes and best practices for protecting their accounts.

Customer Education Methods and Materials

TD Bank utilizes a range of materials, including brochures, online articles, webinars, and social media campaigns, to communicate crucial information about fraud prevention to its customers. They often use clear, concise language and visuals to ensure the information is easily accessible and understandable. Successful campaigns often incorporate real-life examples and actionable steps that customers can take to protect themselves.

Summary

In conclusion, TD Bank’s commitment to fraud prevention involves a combination of internal systems, partnerships with third-party vendors offering early warning services, and proactive customer education. While the specific details of their early warning systems remain proprietary, the bank’s multifaceted approach suggests a strong commitment to protecting its customers from financial fraud. The effectiveness of this approach ultimately depends on the ongoing evolution of fraud techniques and the bank’s ability to adapt and improve its security measures accordingly.

Customers should remain vigilant and utilize the reporting mechanisms provided by TD Bank to promptly report any suspicious activity.