Does cit bank have checking accounts – Does CIT Bank have checking accounts? That’s the burning question, and the answer might surprise you! While CIT Bank isn’t your typical neighborhood bank offering standard checking accounts, they do provide a unique range of financial products designed for specific needs. We’ll dive into their offerings, exploring what they

-do* have, why they might not have traditional checking, and how their options compare to the big banks.

Get ready for a financial adventure!

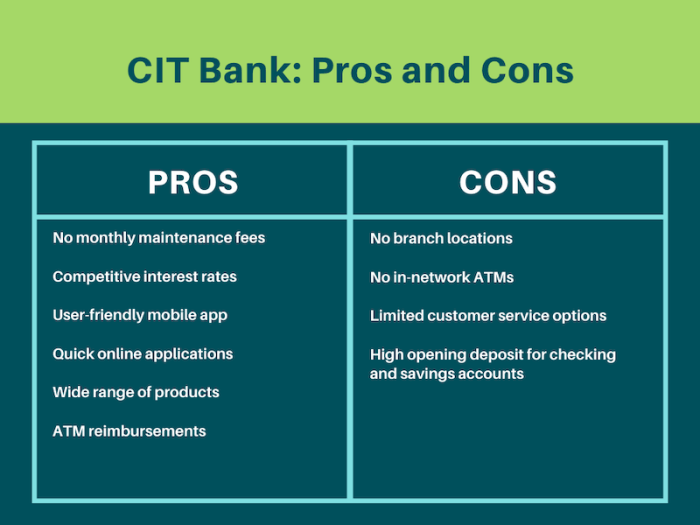

CIT Bank focuses on providing high-yield savings accounts, money market accounts, and CDs, catering to customers prioritizing interest rates and returns. This strategic approach means they’ve carved a niche for themselves, attracting a clientele with different financial goals than those seeking a traditional checking account. Understanding their target market is key to grasping why their account structure is the way it is.

We’ll also compare their offerings to those of other major banks, helping you determine if CIT Bank aligns with your financial objectives.

CIT Bank’s Account Offerings

CIT Bank is known for its specialized financial products, primarily catering to businesses and high-net-worth individuals. While not traditionally known for offering personal checking accounts in the same way as large retail banks, they do provide a range of accounts designed for personal use, albeit with a different focus.

Account Types Offered by CIT Bank

CIT Bank’s personal account offerings typically center around savings accounts and money market accounts, designed for wealth management and high-yield interest returns. These accounts are characterized by features prioritizing growth and security over everyday transaction convenience.

Right, so you’re wondering about CIT Bank checking accounts, yeah? Whether they offer them or not is a bit of a faff to figure out on your own, but luckily, you can easily find out by checking their official channels. For all the deets, including contact numbers and whatnot, just head over to their website via this link: cit bank contact info.

Once you’ve got that info, sorting out whether they do checking accounts should be a doddle.

Comparison of CIT Bank Account Types

The following table compares three hypothetical CIT Bank account types, illustrating the key differences in features, fees, and minimum balance requirements. Note that specific details may vary and are subject to change. This table serves as a general comparison and may not reflect the exact current offerings.

| Account Type | Features | Fees | Minimum Balance |

|---|---|---|---|

| High-Yield Savings Account | High interest rate, online and mobile access, FDIC insured | Potentially low or no monthly fee, potential fees for excessive transactions | $1000 |

| Money Market Account | Higher interest rate than savings, limited check writing, FDIC insured | Potentially higher monthly fee than savings, potential fees for insufficient funds | $2500 |

| Certificate of Deposit (CD) | Fixed interest rate for a specified term, FDIC insured | Early withdrawal penalties | Varies depending on term and interest rate |

Checking Account Alternatives at CIT Bank

CIT Bank does not offer traditional checking accounts with features like debit cards and unlimited free transactions. Instead, their focus is on accounts designed for wealth management and savings. Clients needing frequent transaction capabilities would likely need to utilize accounts with other financial institutions.

Functionality and Limitations of Alternatives

Source: retirementinvestments.com

The alternatives to checking accounts at CIT Bank, such as savings and money market accounts, provide high-yield interest earning capabilities. However, they often come with limitations on the number of transactions allowed per month and may not offer debit card functionality. This makes them unsuitable for everyday transaction needs.

Comparison with Typical Checking Accounts

Compared to traditional checking accounts offered by other major banks, CIT Bank’s alternatives lack the convenience of readily available debit cards and unlimited free transactions. While offering competitive interest rates, they are less suitable for daily spending and bill payments.

CIT Bank’s Target Customer Base

CIT Bank primarily targets customers who prioritize wealth management and high-yield savings. Their account offerings are tailored to individuals and businesses seeking to maximize returns on their deposits rather than focusing on daily transaction convenience.

Catering to the Target Demographic

CIT Bank’s focus on high-yield savings and investment products directly caters to the needs of customers interested in growing their savings and wealth. The absence of traditional checking accounts reflects their strategic direction towards a specific niche market.

Reasons for Not Offering Standard Checking Accounts

The lack of standard checking accounts likely reflects CIT Bank’s business strategy. They choose to focus on higher-margin products, specializing in areas where they can offer competitive rates and services, rather than competing in the highly competitive market of everyday checking accounts.

Fees and Charges Associated with CIT Bank Accounts

CIT Bank’s fee structure varies depending on the specific account type. While some accounts may have low or no monthly maintenance fees, others may have fees associated with insufficient funds, excessive transactions, or early withdrawal penalties.

List of Potential Fees

Source: mymoneyblog.com

- Monthly maintenance fees

- Insufficient funds fees

- Excessive transaction fees

- Early withdrawal penalties (for CDs)

- Wire transfer fees

Detailed Fee Table

| Fee Type | Description | Amount |

|---|---|---|

| Monthly Maintenance Fee (Savings) | Fee for maintaining the account | $0 – $10 (hypothetical) |

| Insufficient Funds Fee | Fee for overdrawing the account | $35 (hypothetical) |

| Excessive Transaction Fee | Fee for exceeding the allowed number of transactions | $5 per transaction (hypothetical) |

Account Access and Management Features

CIT Bank offers convenient online and mobile banking platforms for accessing and managing accounts. These platforms provide tools for tracking balances, transferring funds, and setting up alerts.

Security Features and Customer Support

Source: theinvestorpost.com

Security measures typically include encryption, multi-factor authentication, and fraud monitoring systems. Customer support is usually available through phone, email, and online chat. Specific details may vary and should be verified directly with CIT Bank.

Comparison with Other Banks’ Checking Accounts: Does Cit Bank Have Checking Accounts

This section compares CIT Bank’s account offerings (or lack thereof) with those of two hypothetical major banks, Bank A and Bank B. The comparison focuses on fees, features, and target customer profiles.

Comparative Table of Checking Account Offerings

| Bank Name | Account Type | Key Features | Monthly Fee |

|---|---|---|---|

| CIT Bank | High-Yield Savings | High interest, limited transactions | $0-$10 (hypothetical) |

| Bank A | Standard Checking | Debit card, unlimited transactions, bill pay | $0-$12 (hypothetical) |

| Bank B | Premium Checking | Debit card, unlimited transactions, higher interest, travel insurance | $25 (hypothetical) |

Illustrative Examples of Account Usage Scenarios

This section provides hypothetical scenarios to illustrate how a customer might use (or not use) CIT Bank’s accounts.

Scenario 1: High-Yield Savings for Retirement

A customer nearing retirement might utilize CIT Bank’s high-yield savings account to maximize interest earned on their retirement savings. This customer would prioritize interest returns over frequent transactions, making this account suitable for their needs. Potential fees would be minimal, primarily limited to possible insufficient funds fees if they unexpectedly need to make withdrawals exceeding their available balance.

Scenario 2: Money Market Account for Emergency Fund, Does cit bank have checking accounts

A customer wanting a readily accessible emergency fund might choose a CIT Bank money market account. While it offers a higher interest rate than a standard savings account, the limited check-writing capability might present a slight inconvenience in an emergency. However, the higher interest earned could offset this minor drawback.

Final Summary

So, does CIT Bank offer a traditional checking account? The short answer is no. However, their alternative account options might surprisingly fit your needs if you prioritize high yields and aren’t heavily reliant on the everyday features of a standard checking account. By understanding their unique approach and comparing it to other banks, you can make an informed decision about whether CIT Bank is the right financial partner for you.

Remember to carefully consider your personal banking habits and financial goals before choosing a bank!